Westpac’s economic team has just circulated a note that explains how they’re thinking about things.

The bank’s chief economist, Luci Ellis, has some really interesting things to say.

Let’s start with the big picture. She says the world could be entering an era in which higher interest rates are going to be more common:

“Our house view is that the global structure of interest rates will be somewhat higher in the period ahead than it was in the period between the Global Financial Crisis and the pandemic.

“Looser fiscal policy in the major economies – especially the United States – and the investment needs of the climate transition are reshaping the global balance of saving and investment in ways that the usual saving pools coming from Asia and elsewhere will not offset.

“Higher interest rates are the way these shifts will be equilibrated.

What’s the timeframe we’re talking about here? The climate transition will take more than a few years.

But back home, to the Reserve Bank.

Ms Ellis says she wasn’t surprised to see the RBA keep rates on hold this week, and she feels like are “poised” right now.

She says if events unfold like Westpac’s team think they will, then she expects the RBA will keep rates unchanged until November.

“By that point, inflation should have declined enough for the Board to have comfort that a return to the 2–3% target range is in sight.

“This is a little later than our earlier view that the first rate cut would come at the September meeting.

“With the upside surprise in the March quarter, especially for trimmed mean inflation, it will take longer for inflation to decline far enough that the Board is confident enough of the disinflation trajectory to remove some of the current policy tightness.

“Further upside surprises on inflation would change the calculus, however. While the outlook for inflation in the June quarter has been upgraded, mostly on higher petrol prices, further upside in that quarter and beyond would imply a different trajectory than the one the RBA Board is trying to achieve.

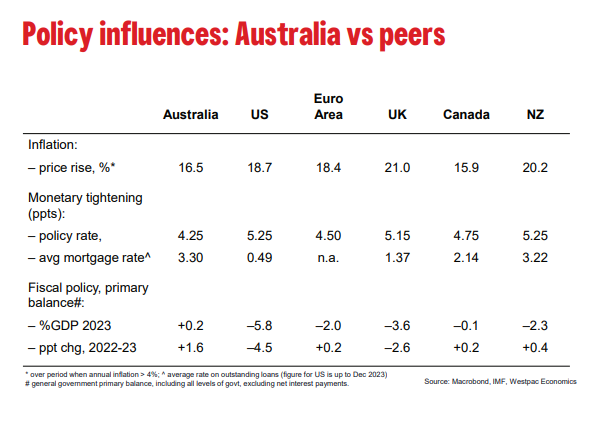

She says there are some big differences between Australia’s economy and the US economy right now, so that’s worth keeping in mind.

“Market pricing had recently been leaning towards the scenario that interest rates would need to increase in Australia.

“Recent upside surprises for US inflation lent weight to the idea that inflation, especially services inflation, would prove sticky and require further policy action to get under control.

“In our view, a straight-through read from the US situation to Australia’s ignores some important distinctions between the two economies, including the weak consumer and more restrictive fiscal policy settings here.

These graphs highlight what she’s talking about:

She also reiterates how much pressure Australian households are under, but she has some good news.

She says pressures will be easing soon.

“Much of 2023’s weakness stemmed from the household sector and this remains the case in early 2024. Consumption has been weak: after growth of only 0.1%qtr, 0.1%yr in the December quarter, indications for March quarter point to a similar result.

“Consumption per person has been falling in Australia, unlike in most peer economies – no wonder consumers are so downbeat.

“For some time we have highlighted the income pressures faced by households. The triple squeeze of a rising cost of living, increasing tax take and higher interest rates has required them to respond by reining in consumption.

“This extraordinary phase of declining real incomes in the face of a tight labour market is coming to a close.

“The drag from inflation has already started to ease, real household disposable income increasing marginally over calendar 2023.

She says a further easing in inflation is expected through 2024.

” A period of steady rates will also help, although there is still some pass-through to come as remaining fixed-rate mortgages roll off (the current high level of interest rates also encouraging some households to save even more by making extra payments against their mortgages).

“More substantive relief for households will come from fiscal policy.

“To date, the squeeze from rising taxation as a share of income has been greater than from rising net interest payments. The Stage 3 tax cuts commencing on 1 July will go some way towards reversing this. Some other targeted cost-of-living support is also likely in the Federal Budget, due the week after we go to press.

“Partly offsetting the relief from lower inflation and fiscal measures, the labour market is likely to soften from here, and wages growth has already peaked.

“Forward indicators of labour demand are softening, including job ads and business surveys

“That said, the starting point for this slowdown is a little stronger than expected a few months ago, with the unemployment rate ticking up to just 3.8% in March and other lag indicators for the labour market also more resilient.”